If you are having a Fixed deposit account in SBI, then this post is for you.

In your fixed deposit account, is there any tax deduction in the interest you are getting?

Don’t worry! Here is the solution and find out what you have to do for that.

Tax deduction in deposit account (ceiling and deduction)

If the interest in your deposit account is up-to INR 40000/- (previously up-to INR 10000/- )* then, there will be no deduction of tax in your Interest.

For senior citizens this ceiling is upto INR 50000/-*.

Above that ceiling, 10% of tax will be deducted from your interest.

*It is officially announced by SBI but check in your branch whether it is implemented or not.

For submitting FORM 15G/15H, PAN is mandatory in your account.

You should be an individual (not a firm or company) and resident of India to be able to submit FORM 15G/15H.

Income below the tax ceiling customers

If you are a customer who is getting interest that falls above the ceilings mentioned above and if you don’t have any other source of income and, if your total income with the interest is below the tax ceilings, you should submit the 15G/15H forms in your branch to avoid tax deduction in the interest.

If it exceeds above your tax ceilings up-to INR 5,00,000/- income, tax will be deducted in your interest but you can get it as refund after filing the tax return at the end of the financial year.

15G/15H Form

The account holders whose age is below 60 should submit the form 15G for every financial year to avoid tax deduction in their deposit account.

If your age is below 60 years, income tax ceiling is INR 2,50,000/- for now.

So up-to that ceiling you do not need to submit form 15G and up-to INR 40000/- interest, tax will not be deducted.

If your are getting income below INR 250000/*-, then your total income with the interest is not exceeding INR 250000/-* (if the interest from deposits is above 40000/-) should submit the 15G form in order to avoid tax deduction in interest of your account.

If your ceiling is above INR 250000/-, you are not eligible to submit the 15G FORM for your deposit account and the tax will be deducted if the interest is above INR 40000/- *(up-to INR 40000/- tax will not be deducted) .

But for an income of up-to INR 500000/-, you can get the deducted amount as refund in your account while filing the tax return for that financial year.

The account holders whose age is above 60 should submit the form 15H to avoid tax deduction in their deposit account.

If your age is above 60 years, the tax ceiling is now INR 3,00,000/-

So up-to that ceiling even if you do not submit form 15G, tax will not be deducted for an interest of up-to INR 50000/-.

If your income is below INR 3,00,000/-*, then you should submit the 15H form in order to avoid tax deduction in the interest if your interest is not exceeding INR 3,00,000/-.

If your ceiling is above INR 3,00,000/-, you are not eligible to submit the 15G form for your deposit account and the tax will be deducted if the interest is above INR 40000/- *(up-to INR 40000/- tax will not be deducted) .

But for an income of up-to INR 5,00,000/-, you can get the deducted amount as refund in your account while filing the tax return for that financial year.

*after deduction of the amount that you have shown in investment declaration.

Please note that submitting the 15G/15H form will not avoid tax completely.

It only helps with tax not being deducted at your branch (according to the above mentioned terms and conditions).

By submitting the form, you declare that your income is below the tax ceiling and hence you request that the tax be not deducted in the interest amount and that you are responsible for the tax payment.

Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income tax Act, 1961 and on conviction, be punishable.

So submit your 15G/15H forms for this financial year in your branch or you can do this via internet banking too.

How to submit Form 15G/15H via SBI internet banking?

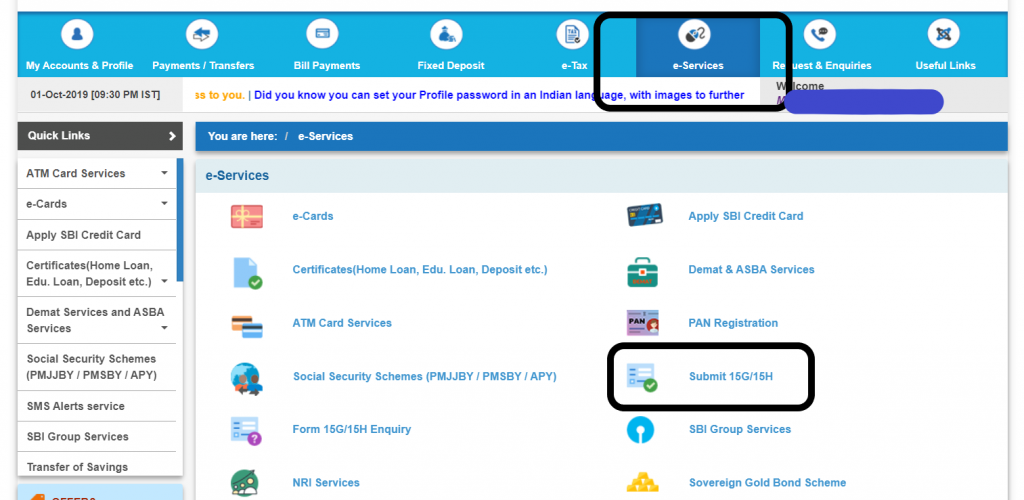

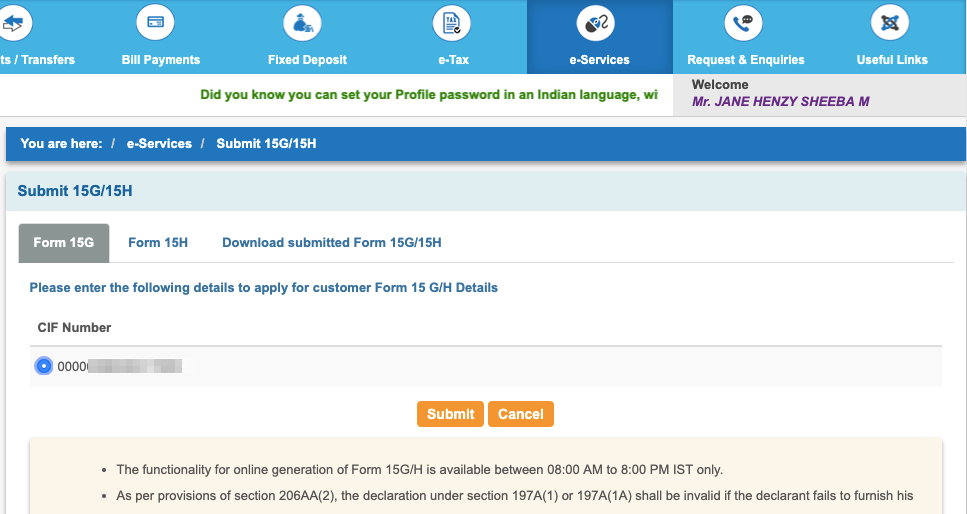

Login to your SBI net banking. Then, click on e-services. Then click on Submit 15G/15H> as shown below.

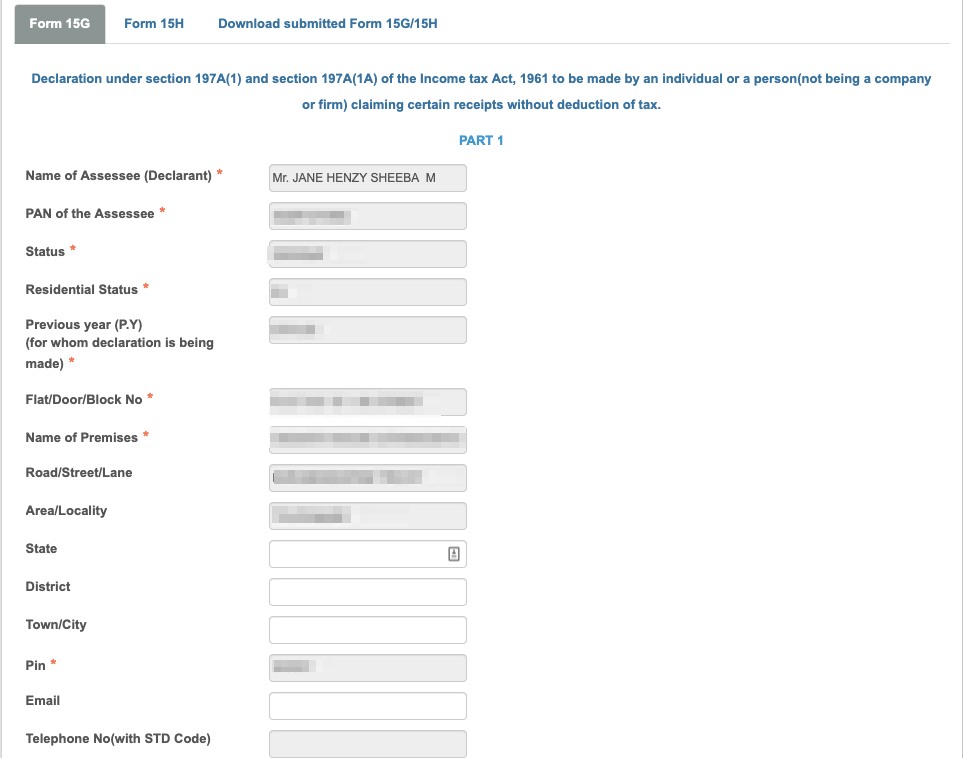

In the following page, fill your details, accept the terms and conditions.

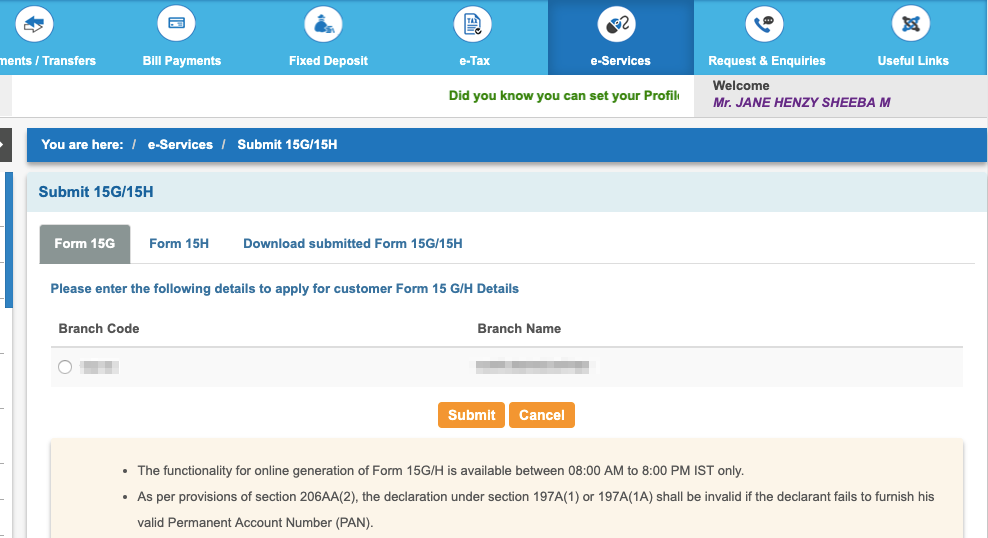

Next, select your branch code:

Next, select the CIF code:

Once you click submit, your form will be submitted.

Form 15G/15H can also be submitted for the corporate bonds, rental income PF withdrawals and Deposits.

Leave a Reply