In today’s video we are going to see how to fill a cheque deposit slip properly.

Banking tasks like writing a Cheque, filling a DD challan/slip, filling a withdrawal slip or filling a deposit slip can always be challenging to some of us.

I have covered the step by step instructions of how to fill a DD challan/slip in another video for which I will share the link in the description below.

When you have to deposit money into a bank account either in the form of cash, or cheque you need to fill a deposit slip.

You may ask, why should I fill in a paper slip to withdraw or deposit money? Can’t that be done without that!

Well, both deposit and withdrawal slips serve serious purpose.

For banks, the slips serve as written proof of every deposit and withdrawal so that no transaction goes unaccounted for at the end of the day.

For us, the customers, it acts as a receipt or a proof in case there is a dispute.

Having said that, in recent times, banks are reducing the use of deposit slips. Since ATM deposits have come to practice, those deposits do not require you to fill a deposit slip.

Some banks have this facility of ATM deposit where the computer can count the cash and read the cheque saving you the trouble of filling in a deposit slip.

A few banks have also smartphone apps that allow you to scan your paper cheque and have the money deposited to your account rather than doing via ATM of the bank counter.

Anyways, the traditional form of depositing money in an account by filling in a deposit slip is quite a thing still!

So in today’s video, let’s see how to properly fill a cheque/cash deposit slip.

When you enter a bank, you can see deposit and withdrawal slips stacked – that you can pick up to fill in.

Or you can ask for one in the counter.

The deposit slip has two parts, the customer copy and the bank’s copy. You need to duly fill in these two copies.

Let’s first focus on the bank’s copy which is on the right side.

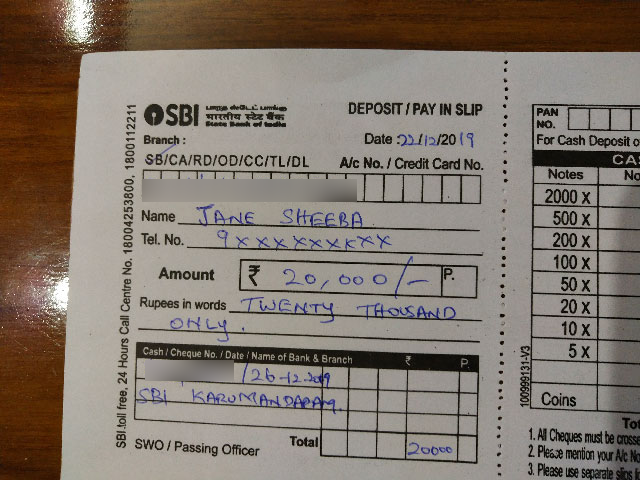

First fill in the name of the branch if that’s not already printed.

The next step is to fill in the date – the day at which you are depositing the cash or cheque.

Then you need to specify the type of the account into which the cash or cheque is going to be deposited.

If the account is a Savings account then strike out everything and just keep SB.

Next write down the account number of the account to which this deposit has to be made.

Then write down the name of the account holder whose account number you wrote above. If it is you, write your name.

Fill out the account number and name very carefully as any mistakes in these two can mess up things.

Then write down your mobile number. Most people ignore this column. But this column helps banks to contact you in case they have any doubts before clearing your deposit.

Next, fill out your email id, if you have one.

The next step is to fill out the amount that you are going to deposit, either by cash or cheque. If it is a cheque, then the amount you fill in should exactly match the amount in the cheque.

Now, if you are going to deposit the money as cash, you have to fill in the denomination of the cash you have at hand.

Count your cash and fill in number of 2000 rupee notes, 500s, 100s and so on.

If you are doing a deposit via cheque, you have to fill in the details of the cheque. The important details that need to be filled in are, the Cheque number, the date, and the name and details of the drawn on bank.

The Cheque number is the six digit number that you will find at the bottom of the cheque.

Fill them appropriately and sign where it says Signature of the depositor.

Now fill the corresponding columns in the customer copy too.

Next, double or triple check all the details carefully, in particular, the account number and name columns, the details of cheque etc. before you proceed to the next step.

If you find any mistakes, simply ignore the slip and fill out a new one.

Hope you found this video/post useful! If so, share it with your friends so they can benefit too!

Can anyone other than the account holder deposit the cheque and sign the deposit slip? Or should the deposit slip be signed by only the account holder?