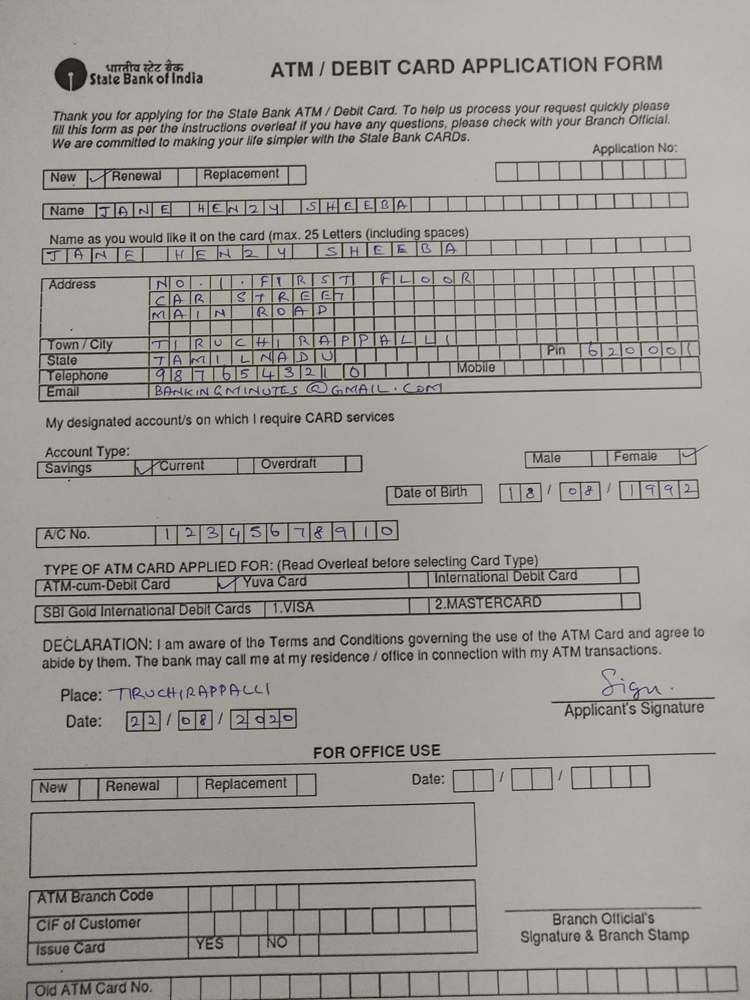

Applying for an SBI debit card (ATM card) is a straightforward process, but filling out the application form correctly is crucial to avoid delays or rejection. Whether you’re applying for a new card, a replacement, or an upgrade, providing accurate information ensures a smooth approval process.

In this guide, we’ll walk you through every section of the SBI ATM card application form with clear explanations and analogies to help you understand it better. By the end, you’ll be confident in filling out the form without errors.

Why is the SBI Debit Card Application Form Important?

Think of the SBI debit card application form as your official request letter to the bank. Just like you wouldn’t expect to receive a driving license without a proper application, the bank won’t issue a debit card unless your details are correctly documented.

The form helps SBI verify your:

- Identity and bank account details

- Eligibility for a specific type of debit card

- Compliance with banking regulations

Filling out the form correctly means fewer visits to the bank and a quicker processing time.

Where to Get the SBI ATM Card Application Form?

You can obtain the form from:

- Your nearest SBI branch – Simply ask for a “Debit Card Request Form.”

- SBI’s official website – Download a printable PDF version.

- Through SBI YONO (for online application) – If you prefer an online application, YONO lets you apply digitally.

Now, let’s go step by step on how to fill it out.

Step-by-Step Guide to Filling the SBI ATM Card Application Form

The form consists of several sections. Let’s break them down one by one.

1. Basic Account Holder Information

This section is where you provide personal details. Imagine you’re introducing yourself to someone for the first time—you’d start with your name, date of birth, and contact details.

- Full Name: Write your name exactly as per your bank records.

- Account Number: Your 11-digit SBI account number (ensure there are no mistakes).

- Branch Name & Code: Mention the SBI branch where you hold your account. The branch code is usually found on your passbook.

- Mobile Number & Email ID: This is crucial because SBI will send OTPs and updates regarding your debit card application.

2. Type of Debit Card Required

SBI offers various debit cards with different features. Just like choosing between a regular and premium smartphone, you need to select a card that suits your needs.

Common SBI debit card options include:

- Classic Debit Card – Basic card with standard withdrawal and shopping limits.

- Platinum Debit Card – Higher transaction limits with added benefits.

- Global International Debit Card – For those who need international transaction access.

Tick the box corresponding to your preferred card type. If unsure, ask your bank representative.

3. Mode of Card Delivery

SBI offers two options:

- Branch Pickup – You collect the card from your SBI branch.

- Courier Delivery – The bank sends it to your registered address.

If you choose courier, ensure your address is up to date in the bank’s records.

4. Reason for Application

This section asks why you’re applying for a debit card. Options include:

- New Card – First-time application.

- Replacement Card – If your previous card was lost, stolen, or damaged.

- Upgraded Card – If you need a higher variant with more benefits.

Tick the appropriate box. If you’re replacing a lost card, the bank may ask for additional verification.

5. Nominee Declaration (If Required)

If you want a nominee for your debit card transactions, you can fill in their details here. However, this is optional and generally not required unless you’re applying for a special-purpose card.

6. Signature & Declaration

The final step is signing the form. This is like signing a contract—it confirms that all the details you provided are correct.

- Ensure your signature matches the one in your bank records to avoid rejection.

- If you’re submitting the form in person, you might need to sign in front of a bank official.

Common Mistakes to Avoid While Filling the Form

Even a small mistake can delay your application. Here’s what to watch out for:

- Incorrect Account Number: A wrong digit means the form won’t be processed.

- Illegible Handwriting: If the bank can’t read your form, processing will be delayed. Write clearly.

- Mismatch in Signatures: Always match the signature in your bank records.

- Incomplete Form: Ensure all mandatory fields are filled to avoid rejection.

How to Submit the SBI ATM Card Application Form?

Once you’ve filled the form, follow these steps to submit it:

1. Attach a photocopy of your Aadhaar or PAN card (for identity verification).

2. Visit your SBI branch and submit the form at the customer service desk.

3. The bank official may ask for additional verification.

4. You’ll receive an SMS confirming that your request is being processed.

Your debit card will be ready within 7-10 working days, depending on the delivery mode chosen.

What to Do After Receiving Your SBI Debit Card?

Once you receive your new ATM card, you must:

- Activate it using an ATM – Insert the card, enter your PIN, and follow on-screen instructions.

- Change the PIN – Set a new PIN for security.

- Link it to mobile banking or YONO – For easy transactions.

- Ensure it works – Try a small transaction or balance inquiry.

Frequently Asked Questions (FAQs)

1. Can I apply for an SBI debit card online?

Yes, you can apply via SBI YONO. However, some variants require a branch visit.

2. How long does it take to get a new SBI ATM card?

It usually takes 7-10 working days, but it can be quicker for branch pickup.

3. Is there a fee for replacing a lost SBI debit card?

Yes, SBI may charge a nominal fee for replacement cards.

4. What should I do if my application is rejected?

Visit your branch and ask for clarification. It could be due to incorrect details or missing documents.

Final Thoughts

Filling out the SBI ATM card application form is a simple yet crucial task. By following this guide, you can ensure that your form is error-free and your application is processed smoothly.

If you haven’t applied for your SBI debit card yet, download the form or visit your nearest branch today. The sooner you apply, the sooner you can enjoy hassle-free transactions with your new card!

it was very helpful. and effectiv