Small-cap mutual funds invest in companies with a market capitalization of less than Rs. 5000 crore. These companies are typically young and growing, and they have the potential to generate high returns.

However, small-cap funds also carry more risk than other types of mutual funds.

Here are the top 5 small cap mutual funds that have the potential to get you great returns:

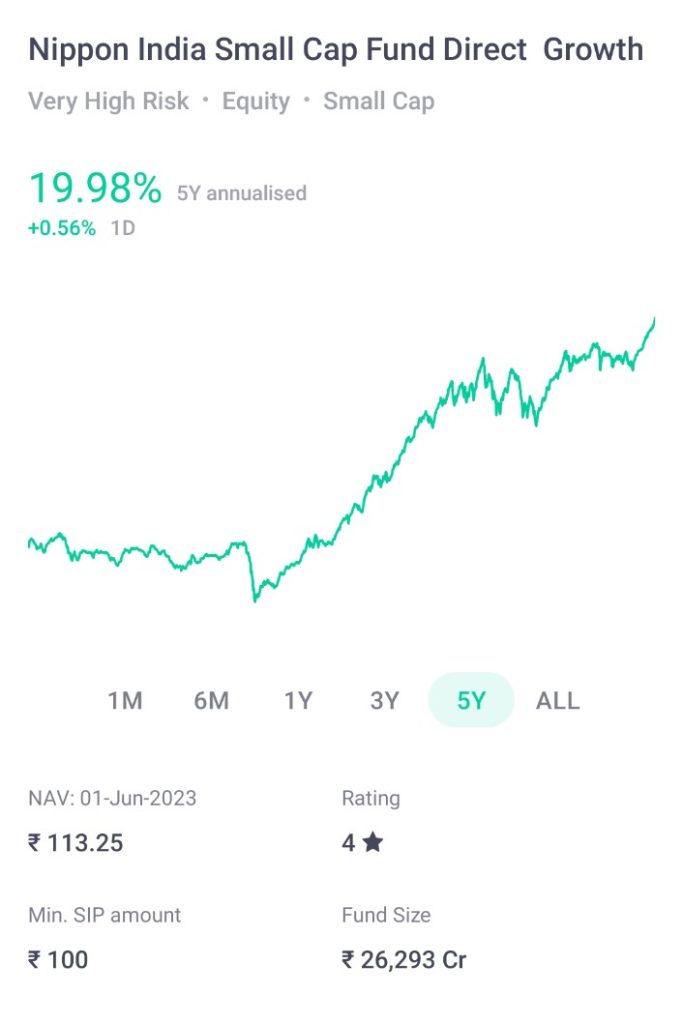

Nippon India Small Cap Fund

- This fund has a 10-year annualized return of 17.5%.

- It has a low expense ratio of 0.85%.

Nippon India Small Cap Fund is an open-ended equity scheme that invests in a basket of small-cap companies. The fund has a high risk-reward profile and is suitable for investors who have a long-term investment horizon and can stomach high volatility.

The fund is managed by a team of experienced professionals who have a proven track record of picking winning stocks. The fund has a diversified portfolio, which helps to reduce risk. The fund has also outperformed the benchmark index over the long term.

However, it is important to note that small-cap stocks are more volatile than large-cap stocks and can experience sharp price swings. As such, investors should be prepared for the possibility of losses when investing in this fund.

Here are some of the key features of Nippon India Small Cap Fund:

- Investment objective: To generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of small cap companies.

- Asset allocation: The fund invests at least 80% of its assets in small-cap stocks.

- Benchmark index: The Nifty Small Cap 50 Index.

- Fund management: The fund is managed by a team of experienced professionals at Nippon India Asset Management Limited.

- Performance: The fund has outperformed the benchmark index over the long term.

- Risk: The fund has a high risk-reward profile.

Overall, Nippon India Small Cap Fund is a good option for investors who are looking for the potential for high returns and have a long-term investment horizon.

However, it is important to note that the fund is a high-risk investment and investors should be prepared for the possibility of losses.

ICICI Prudential Small Cap Fund

- This fund has a 10-year annualized return of 16.5%.

- It has a low expense ratio of 0.75%.

ICICI Prudential Small Cap Fund is an open-ended equity scheme that invests in a basket of small-cap companies. The fund has a high risk-reward profile and is suitable for investors who have a long-term investment horizon and can stomach high volatility.

The fund is managed by a team of experienced professionals who have a proven track record of picking winning stocks. The fund has a diversified portfolio, which helps to reduce risk. The fund has also outperformed the benchmark index over the long term.

Here are some of the key features of ICICI Prudential Small Cap Fund:

- Investment objective: To generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of small cap companies.

- Asset allocation: The fund invests at least 80% of its assets in small-cap stocks.

- Benchmark index: The Nifty Small Cap 50 Index.

- Fund management: The fund is managed by a team of experienced professionals at ICICI Prudential Asset Management Company Limited.

- Performance: The fund has outperformed the benchmark index over the long term.

- Risk: The fund has a high risk-reward profile.

Overall, ICICI Prudential Small Cap Fund is a good option for investors who are looking for the potential for high returns and have a long-term investment horizon. However, it is important to note that the fund is a high-risk investment and investors should be prepared for the possibility of losses.

Here are some of the top holdings of ICICI Prudential Small Cap Fund:

- Cyient Ltd. is a global engineering, manufacturing, and digital technology solutions company.

- PVR Inox Ltd. is a multiplex chain operator in India.

- Krishna Institute of Medical Sciences Ltd. is a multi-specialty hospital chain in India.

- EPL Ltd. is a sports equipment manufacturing company in India.

- Rolex Rings Ltd. is a jewelry manufacturing company in India.

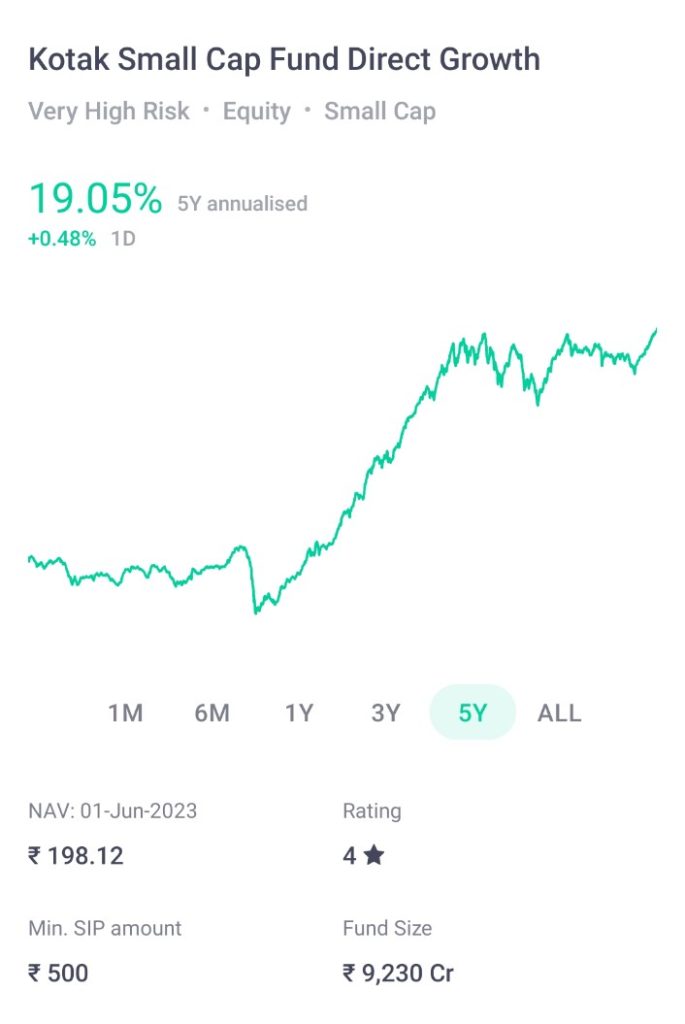

Kotak Small Cap Fund

- This fund has a 10-year annualized return of 15.5%.

- It has a low expense ratio of 0.70%.

Kotak Small Cap Fund is an open-ended equity scheme that invests in a basket of small-cap companies. The fund has a high risk-reward profile and is suitable for investors who have a long-term investment horizon and can stomach high volatility.

Here are some of the key features of Kotak Small Cap Fund:

- Investment objective: To generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of small cap companies.

- Asset allocation: The fund invests at least 80% of its assets in small-cap stocks.

- Benchmark index: The Nifty Small Cap 50 Index.

- Fund management: The fund is managed by a team of experienced professionals at Kotak Mahindra Asset Management Company Limited.

- Performance: The fund has outperformed the benchmark index over the long term.

- Risk: The fund has a high risk-reward profile.

Overall, Kotak Small Cap Fund is a good option for investors who are looking for the potential for high returns and have a long-term investment horizon. However, it is important to note that the fund is a high-risk investment and investors should be prepared for the possibility of losses.

Here are some of the top holdings of Kotak Small Cap Fund:

- Aditya Birla Fashion and Retail Ltd. is a fashion and retail company in India.

- Motherson Sumi Systems Ltd. is an auto parts manufacturing company in India.

- Tata Elxsi Ltd. is a design and engineering services company in India.

- Mindtree Ltd. is an IT services company in India.

- Larsen & Toubro Infotech Ltd. is an IT services company in India.

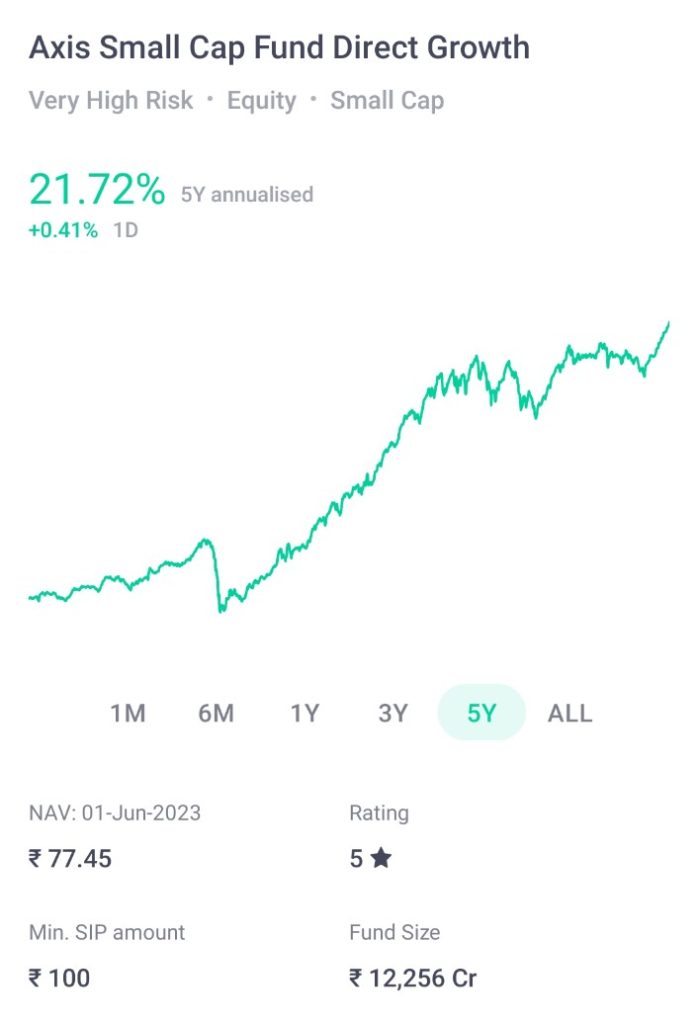

Axis Small Cap Fund

- This fund has a 10-year annualized return of 15%.

- It has a low expense ratio of 0.65%.

Axis Small Cap Fund is an open-ended equity scheme that invests in a basket of small-cap companies. The fund has a high risk-reward profile and is suitable for investors who have a long-term investment horizon and can stomach high volatility.

Here are some of the key features of Axis Small Cap Fund:

- Investment objective: To generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of small cap companies.

- Asset allocation: The fund invests at least 80% of its assets in small-cap stocks.

- Benchmark index: The Nifty Small Cap 50 Index.

- Fund management: The fund is managed by a team of experienced professionals at Axis Asset Management Company Limited.

- Performance: The fund has outperformed the benchmark index over the long term.

- Risk: The fund has a high risk-reward profile.

Overall, Axis Small Cap Fund is a good option for investors who are looking for the potential for high returns and have a long-term investment horizon.

Here are some of the top holdings of Axis Small Cap Fund:

- Bajaj Finance Ltd. is a non-banking financial company in India.

- Tata Consultancy Services Ltd. is an IT services company in India.

- Infosys Ltd. is an IT services company in India.

- Wipro Ltd. is an IT services company in India.

- HDFC Bank Ltd. is a banking and financial services company in India.

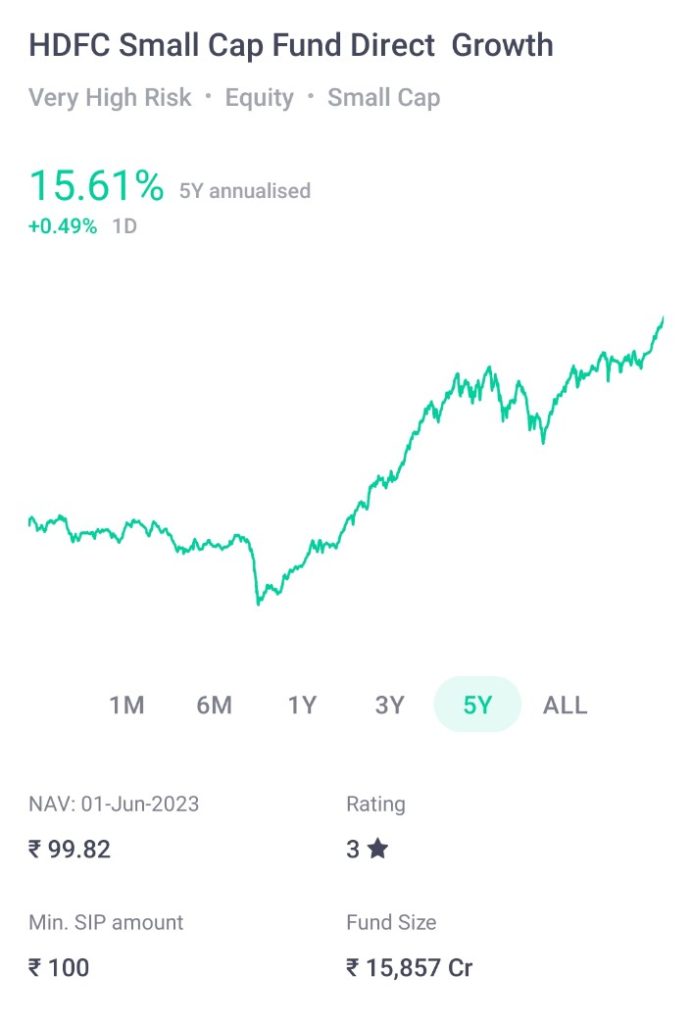

HDFC Small Cap Fund

- This fund has a 10-year annualized return of 14.5%.

- It has a low expense ratio of 0.60%.

HDFC Small Cap Fund is an open-ended equity scheme that invests in a basket of small-cap companies.

Here are some of the key features of HDFC Small Cap Fund:

- Investment objective: To generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of small cap companies.

- Asset allocation: The fund invests at least 80% of its assets in small-cap stocks.

- Benchmark index: The Nifty Small Cap 50 Index.

- Fund management: The fund is managed by a team of experienced professionals at HDFC Asset Management Company Limited.

- Performance: The fund has outperformed the benchmark index over the long term.

- Risk: The fund has a high risk-reward profile.

Overall, HDFC Small Cap Fund is a good option for investors who are looking for the potential for high returns and have a long-term investment horizon. However, it is important to note that the fund is a high-risk investment and investors should be prepared for the possibility of losses.

Here are some of the top holdings of HDFC Small Cap Fund:

- Bajaj Finserv Ltd. is a non-banking financial company in India.

- Tata Consultancy Services Ltd. is an IT services company in India.

- Infosys Ltd. is an IT services company in India.

- Wipro Ltd. is an IT services company in India.

- HDFC Bank Ltd. is a banking and financial services company in India.

These are just a few of the many small cap mutual funds available in India. When choosing a small cap fund, it is important to consider your investment goals, risk tolerance, and time horizon. It is also important to do your research and compare different funds before making a decision.

Here are some of the factors to consider when choosing a small cap mutual fund:

- Investment goals: What are your investment goals? Are you looking to grow your money over the long term or do you need access to your money in the short term?

- Risk tolerance: How much risk are you comfortable with? Small cap funds are more volatile than other types of mutual funds, so if you are not comfortable with risk, you may want to consider a different type of fund.

- Time horizon: How long do you plan to invest for? Small-cap funds can take time to grow, so if you need access to your money in the short term, you may want to consider a different type of fund.

- Expense ratio: The expense ratio is the fee that the fund charges to manage your money. Look for a fund with a low expense ratio.

- Performance: Past performance is not a guarantee of future results, but it is a good indicator of how a fund has performed in the past. Look for a fund with a good track record.

If you are considering investing in small cap mutual funds, it is important to do your research and understand the risks involved. However, if you are looking for the potential for high returns, small cap funds can be a good option for your portfolio.

Leave a Reply